Title: PM suspends chief commissioner inland revenue, others

Share:

Linkedin

Whatsapp

Facebook

Description:

Description:

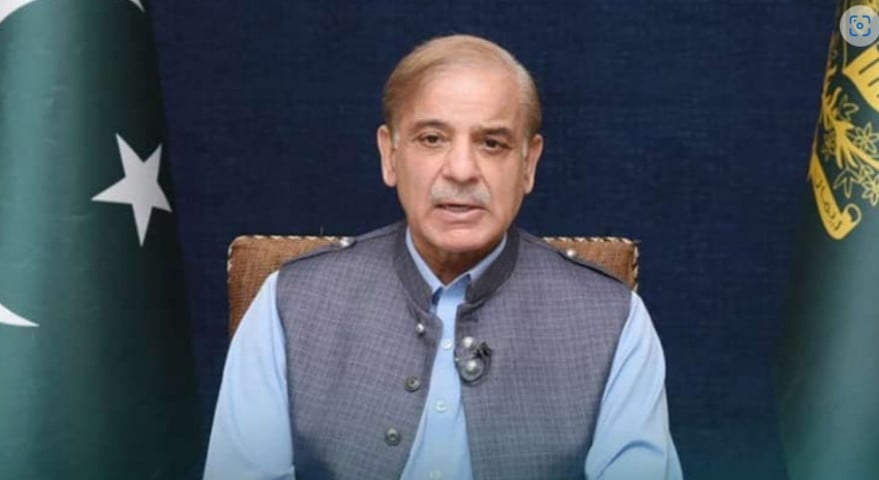

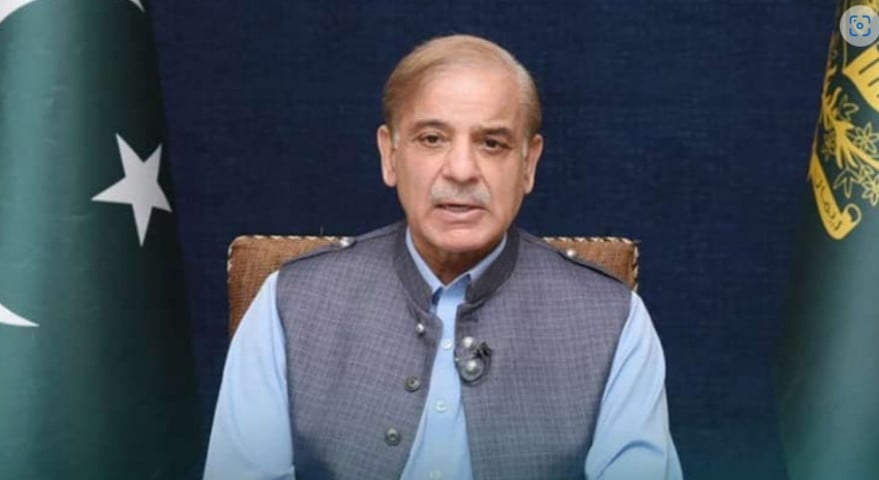

Prime Minister Shehbaz Sharif ordered the suspension of the Inland Revenue Service's chief commissioner and other relevant officials on Tuesday after he took notice of the “willful” delay in tax cases.

The prime minister also ordered initiating an inquiry against the officers.

Soon after assuming office, the prime minister directed immediate reforms in the Federal Board of Revenue (FBR) and decided to oversee the process himself.

As per details, cases worth billions of rupees related to government revenues have been pending adjudication in tax tribunals. The prime minister had requested the chief justice of Pakistan for the early disposal of these cases.

The premier recently took notice of a case in which an FBR counsel had sought adjournment and directed the relevant authorities to inquire into the matter.

Read PM takes charge of FBR overhaul

He observed that the national exchequer was suffering due to the pendency of tax matters involving billions of rupees.

Shehbaz expressed zero tolerance over lethargy in pursuing these legal matters and pledged to monitor tax reforms.

“For enhancing revenue and saving every penny of the country and nation, they would have to strive day and night,” the press release quoted the prime minister as saying.

Currently, 145,036 cases are pending in various courts, in which tax cases involving an amount of Rs 4.23 trillion are yet to be decided.

FBR officials said 19,528 cases involving Rs740 billion were pending in four high courts.

They added that the Supreme Court had yet to decide 3,455 tax-related cases involving a sum of Rs1.40 trillion. A sum of Rs2.23 trillion belonging to the federal government is stuck because of tax disputes.

The government is also considering introducing legislation to abolish the offices of the FBR’s Inland Revenue appeal commissioner where cases involving an amount of Rs1.15 trillion were hit by delays.

Published Date: 23-Apr-2024

Share:

Linkedin

Whatsapp

Facebook